Latest News

Blog

SCE Target Date Funds: How Do They Fit Into Your Retirement Investment Strategy?

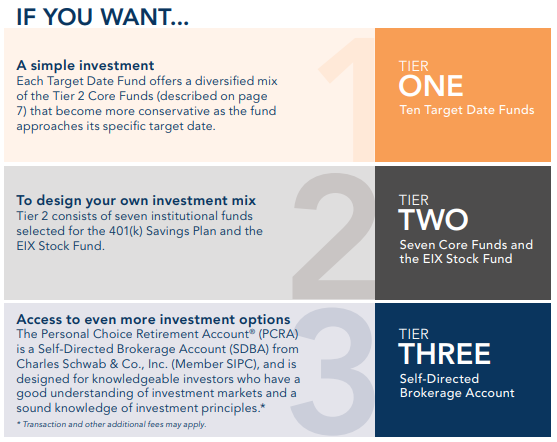

Planning for retirement is not a “one-size-fits-all” strategy, nor does a financially secure future just happen without careful consideration. A 401K is just one component of an investment and savings strategy that should work in combination with social security and other savings. To find an appropriate balance, Southern California Edison offers a tiered approach to 401k investment plans. This provides a choice amongst different ways to invest, allowing you to choose a plan that aligns with your goals, timeline and risk tolerance. Here we examine Tier 1: Target Date Funds.

The amount of money you have at retirement depends on not only how much you invest, but how you invest it. If you are too conservative, you might not have as much as you need. Be too aggressive and you can take a loss and not have time to recover it. Every person will have a different situation and goals, as well as timelines in which to accomplish these goals. Enter the Southern California Edison’s Target Date Funds.

What is a Target Date Fund?

The SCE Target Date Funds are a mix of stocks, bonds and other investments which are optimized toward maximizing their value by a certain target date (usually the individual’s projected retirement age). Upon hitting that target date, the participants would then gradually start withdrawing money from the plan.

Over time, the fund mix will shift from more aggressive to more conservative as the target date approaches. In the beginning, the fund will focus on growth potential, often heavily loaded with stocks, and considered to be more aggressive with a higher risk mix. As the target date draws closer, the funds adjust to gradually take on more conservative strategies, which are less tolerant to fluctuations in the market. When the fund is close to the target date, it will be made up of mostly bonds/cash equivalents… extremely stable funds appropriate for someone who is ready to retire.

To the Southern California Edison employee investing in this option, these funds adjust automatically based on the length of time to the target date. Of course, there is nothing automatic about the backend management, where market conditions are constantly analyzed, adjusting as needed to help maximize return. The SCE Target Date Fund is adjusted based on the age of the investor and the stage they are in: Young Saver, Midlife Saver, New Retiree or Senior Retiree. Note that even after the target date has passed, the fund still operates to adjust investments for the retirement years.

The SCE Target Date Fund may be a good choice for SCE employees who seek an easy and simple approach in their investment strategy. The mix aims to deliver a complete and diversified portfolio for the person who wants the security of knowing their investments have their retirement goals in mind, self-adjusting throughout the timeline toward the target date.

According to a recent Vanguard finding, about three-fourths of large 401(k) plans offer Target Date Funds to their employees and more than half of participants are now invested in a single TDF, compared to only 13% just ten years ago. Despite their popularity, it is crucial to note that, like any investment strategy, they are not without their risks. Historically, these funds have underperformed other investment options, and there are no guaranteed returns. Work with a financial consultant who understands your goals to determine if the SCE Target Date Fund is right for you.

Download a PDF of this article

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material.

The principal value of a target fund is not guaranteed at any time, including at the target date.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Stratos Wealth Partners, a registered investment advisor and separate entity from LPL Financial.