Latest News

Blog

SCE Tier 2 Core Funds: How Do You Build Your Own Strategy?

In our previous article, “SCE Target Date Funds: How Do They Fit Into Your Retirement Investment Strategy?” we investigated the Tier 1 Target Date Funds offered to SCE employees in their retirement benefits plans. Planning for retirement is not a “one-size-fits-all” strategy, nor does a financially secure future just happen without careful consideration. To find an appropriate balance, Southern California Edison offers a tiered approach to 401k investment plans Today we will continue looking at these plans with their Tier 2 option: Core Funds.

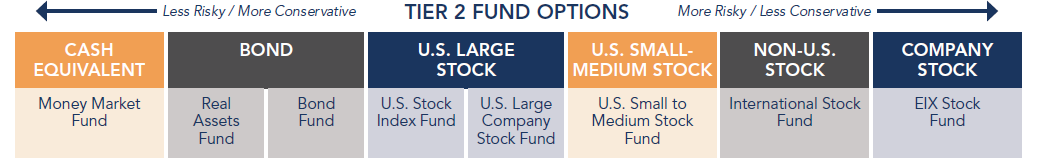

SCE offers employee’s the option to create their own portfolio using the SCE Tier 2 Core Funds. This alternative enables you to choose your own investment mix from seven Core Funds and the EIX Stock Fund, representing a range of asset classes (stocks, bonds and cash equivalents) with varying degrees of risk.

Building Your Investment Strategy

This route places more responsibility on the employee to research and choose the best funds for their individual situation and goals. It puts the onus on the plan participant to pay attention and regularly check on the performance, possibly making adjustments. This requires time, patience and know-how to take this on.

Your Time

When will you want to start withdrawing funds? One of the biggest considerations in 401 (k) investing is always how much time do you have? The more time to retirement age, the more aggressively people tend to invest because they can absorb the ups and downs of the market. Conversely, the less time you have, the more conservative you may want to be in your approach.

Your Risk Tolerance

How comfortable are you with risk? Are you conservative, moderate or aggressive? When you are aware of the type of investor you are, you can choose a strategy that aligns with your level of comfort with market volatility.

After you understand both the time you have to work with and your tolerance towards risk, you can then choose among the Tier 2 Funds to create an investment strategy that is best for you. But keep in mind, the Tier 2 Core Fund approach is not a set it and forget it strategy.

Download a PDF of this article

*The Roth IRA offers tax deferral on any earnings in the account. Withdrawals from the account may be tax free, as long as they are considered qualified. Limitations and restrictions may apply. Wi thdrawals prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later,

may result in a 10% IRS penalty tax. Future tax laws can change at any time and may impact the benefits of Roth IRAs. Their tax treatment may change.

An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

An investment in Exchange Traded Funds (ETF), structured as a mutual fund or unit investment trust, involves the risk of losing money and should be considered as part of an overall program, not a complete investment program. An investment in ETFs involves additional risks such as not diversified, price volatility, competitive industry pressure, international political and economic developments, possible trading halts, and index tracking errors.

The prices of small and mid-cap stocks are generally more volatile than large cap stocks.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The principal value of a target fund is not guaranteed at any time, including at the target date.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Stratos Wealth Partners, a registered investment advisor and separate entity from LPL Financial.